Economic recovery maintains momentum, despite growing concern over consumption

China’s economic recovery maintained momentum in August as factories expanded production and retail sales expanded for the first time this year, in spite of the dual pressure of the epidemic and flooding, according to data released Tuesday by the National Bureau of Statistics. Investment and industrial production continued to lead the economic recovery, while consumption remained a weak factor.

On the supply side, value-added industrial output, which measures production by factories, mines and utilities, grew by 5.6% year-on-year in August, marking the fastest gain in eight months. Specifically, industries which are strongly correlated with infrastructure and property investment made the biggest contribution in August.

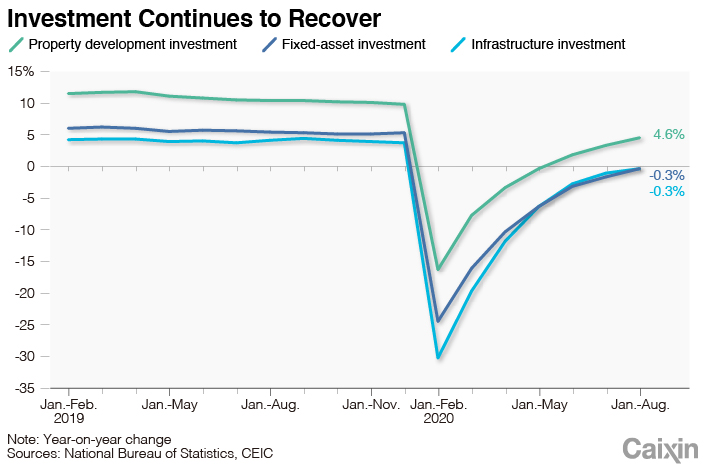

Fixed-asset investment (FAI), a key driver of domestic demand that includes infrastructure spending, fell 0.3% year-on-year in the first eight months, improving from a 1.6% drop over the first seven months. Notably, the improvement was driven by private firms, demonstrating that pandemic-related support measures have taken effect. Private FAI increased 19.5% in August compared to a year earlier, up from a 5.2% increase in July.

|

Infrastructure investment shrank 0.3% year-on-year in the first eight months, narrowing from a 1% decline in the January-to-July period. But it is set to accelerate in the coming months following the surge in government bond issuance, along with the remaining 980 billion yuan of local government debt quota still left for September and October.

Investment in real estate development remained strong, rising 4.6% year-on-year in the first eight months, accelerating from a 3.4% rise in the January-to-July period, although this may not continue in light of new restrictions on real estate financing discussed below.

Economists at London-based Capital Economics Ltd. wrote that the growth in industry and construction is likely to remain strong as fiscal spending is set to ramp up, and the recent surge in industrial profit growth has boosted the prospects for manufacturing investment.

But the most important piece of data was far less positive. While retail sales grew for the first time this year, reversing a 1.1% drop in July, they only rose 0.5% year-on-year last month, and actually shrank if you exclude car purchases. This is not at all a good sign for economic recovery in a country which has all but eliminated Covid-19 within its borders, and does not bode well for the “dual circulation” strategy which hinges on increasing domestic demand.

Policymakers and economists have taken notice, as we discussed last week, but we’re not seeing much yet in terms of policy interventions that address the root issues.

PBOC gets a big stick

Sweeping new rules released Sunday by the State Council and PBOC put a regulatory framework in place for financial holding companies, taking them out of a grey area with patchy supervision, and bringing them within the scope of more standardized and comprehensive government oversight.

The broad expansion of the central bank’s regulatory power comes as an explicit response to high-profile financial scandals stemming from groups like Anbang Insurance Co. Ltd., HNA Group Co. Ltd. and Tomorrow Holding Co. Ltd.

Pan Gongsheng, 潘功胜, a deputy governor of the PBOC, said on Monday the rules aim to address regulatory gaps and rein in the blind expansion of nonfinancial companies in the financial sector. These have brought mounting risks due to their complicated organizational structure, concealed equity structure, and behaviors including cross-shareholding, circular capital injection, false capital injection, and more.

Caixin Global has an explainer discussing the four things you need to know about the new rules so we won’t bore you with too many of the details covered there. But it’s worth emphasizing that this is a very significant policy development set to impact a wide swathe of companies in numerous industries. China probably has more nominally nonfinancial companies involved in finance than anywhere else in the world, and the new rules give regulators far more power than ever before to get a handle on them. They were sure not to leave any loopholes, with lists of requirements ending in variations on “or the PBOC says so.”

But as always, the devil is in the details and it’s enforcement that will really matter. What we have now is a framework, but more detailed rules will be needed to implement it.

Developers buying less land

Following the “red line” leverage restrictions announced for developers we discussed earlier this month, an unusual situation has emerged — land sales are slowing even as property sales are accelerating.

Previously, when real estate sales grew, cash-rich developers would load up on extra debt to buy land. “This logic has undergone some changes under current policy pressure,” an anonymous senior executive at a real estate developer said.

Since April, new home sales have been better than expected, largely driven by the release of pent-up demand as the housing market started to recover from the domestic Covid-19 epidemic, along with efforts by over-levered developers to sell down their inventory. At the end of August, nearly 70% of China’s leading 100 developers saw their year-to-date sales grow year-on-year, according to property consultancy China Real Estate Information Corp.

But in 60 cities monitored by real estate services firm Leju Holdings Ltd. (link in Chinese), developers’ land purchases were down nearly 30% week-on-week in the last week of August. “The regulatory tightening on developers’ financing is likely the main reason behind the decline,” the agency said.

This heralds a major change in the industry. Previously, the more land reserves a real estate developer had in hand, the more financial resources it had access to, which in turn allowed it to acquire more land reserves and fueled rapid expansion. In the future, most developers will instead purchase land based on their operating cash flow, rather than how much money they are able to borrow, as financial institutions are pushed to provide financing based on a developer’s stability, rather than its size, said the anonymous senior executive.

Download our app to receive breaking news alerts and read the news on the go.

You've accessed an article available only to subscribers

VIEW OPTIONS

"consumption" - Google News

September 17, 2020 at 06:48PM

https://ift.tt/35RB870

Caixin Insight: Shrinking Consumption Becomes a Growing Problem - Caixin Global

"consumption" - Google News

https://ift.tt/2WkKCBC

https://ift.tt/2YCP29R

Bagikan Berita Ini

0 Response to "Caixin Insight: Shrinking Consumption Becomes a Growing Problem - Caixin Global"

Post a Comment