After a long hunkering down, the economic engine will start whirring again from Monday, as India relaxes lockdown restrictions in a graded fashion. Those who have stayed mostly indoors for more than a month to prevent the spread of a deadly virus will start stepping out, to produce and to consume, pushing the twin levers of the economy.

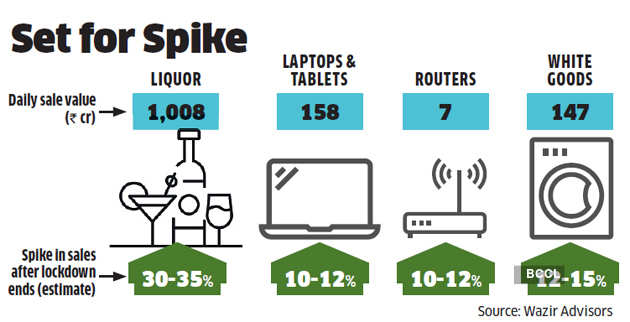

It will begin gingerly at first, and then depending on how the virus and associated restrictions move, activity will expand, and, hopefully, things will be back to full steam eventually. On the consumption front, demand will likely spike in certain categories and we might even witness some amount of “relief ” or “revenge” consumption among the higher economic strata as a reaction to having been denied access to retail therapy.

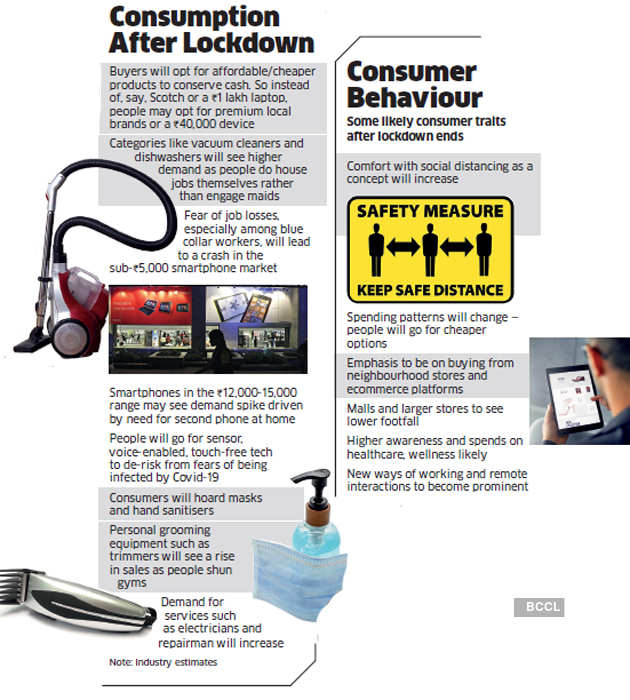

As affluent households have had to come to terms with patchy access to help for domestic chores, product categories such as dishwashers and vacuum cleaners might witness a surge in sales. Delhi-based Pooja Mittal, who works with a law firm, plans to buy a dishwasher and other gear that can help automate the kitchen. “A machine-driven mop will be a good idea,” she says. Such a mop doesn’t exist, but could well become a fit category for R&D in a post-Covid-19 world.

Mittal adds, “I have a better appreciation now of what a maid goes through -so a dishwasher makes eminent sense.”

Even as kitchen-related consumption will doubtless kick into high gear, equipment to enable working from home — computers, printers, accessories and peripherals — will likely see a surge, too. In north India, where summer is fast approaching, sales, servicing and repairs of air conditioners will see a boost. Same will be the case with water purifiers, as the lockdown experience would have woken up many households to the perils of relying on the supply of bottled water. For many, replenishing the home bar will be a priority. Personal grooming kits will see a spike in demand as salons remain out of reach but people have to look their best on conference calls nonetheless.

“This is the first-of-its kind supply challenge for consumers. Hygiene, health & wellness and staples will continue their upward trajectory in buyers list, while there will be a surge in demand for ice cream, alcohol, home computing and white goods,” says Anurag Mathur, partner & leader, retail & consumer, PwC India.

Urban Company (previously Urban Clap) claims 8-10 million job orders are pending for all kinds of repairs. It is training staff to do things like “contact-less air con service”. March to June sees 45% of annual sales of ceiling fans, and 7% sales of all coolers. Ravindra Singh Negi, president, electrical consumer durables, Havells India, says: “Replacement sales will happen while upgrades will be postponed.”

He also sees a spike in demand for trimmers, hair dryers and shavers, as people will continue to avoid salons for a while. These comprise 60% of the Rs 1,300 crore grooming business. “DIY products like hair colour, grooming and shaving products will see increase in demand,” says Kumar Rajagopalan, CEO, Retailers Association of India.

With no past reference available to judge how consumer behaviour will shape up after a pandemic-induced lockdown, marketers and analysts expect to see a cautious customer who wants to stock up to be able to work from home but also conserve cash. Nikhil Prasad Ojha, partner, Bain & Company, points out that consumer behaviour will change with emphasis on comfort with social distancing and rebuilding the kitty. People will buy more from neighborhood stores and online and less from malls and large stores.

“Definition of essential will change. We could definitely see a spike in penetration of categories that will make working from home easier — tablets, vacuum cleaners, easy to use mops, etc. Products that promise to boost immunity will also see a spike,” adds Ojha.

Spending with an eye on the wallet could translate into people buying the more affordable stuff and even going for a brand or a price point a notch below their regular pre-Covid shopping list. Millions of professionals went into the lockdown with barely a few hours of notice. And suddenly found themselves working from home, studying from home and doing household chores alongside. This experience will likely drive home the importance of bolstering the work arrangement people have at home.

Rahul Agarwal, CEO & MD, Lenovo India, says: “Computer as a product will be more relevant. Computers will move up the pecking order of things that people buy for home. Education as a reason to buy devices will also become important.”

Analyst firm IDC sees an uptick of at least 30% in sale of laptops and tablets with printers also seeing a 8-10% increase in sales from the pre-lockdown period. There could also be bundled offers of laptops and printers. On the other hand, mobile phone analyst Counterpoint Research sees a fall in demand for entry level and sub-Rs 5,000 devices as this category will hold on to cash fearing job losses. However, the midrange smartphones that enable OTT content consumption, edutech and gaming, will pick up even as closer to year-end festive season sales see a bigger spike.

Anil Goteti, senior vice-president, Flipkart, says: “We expect a potential demand surge after the easing of the lockdown. This surge is likely to be pronounced in the consumer electronics category.” Walmart owned Flipkart claims a reach of 200 million consumers in India and expects a potential demand surge after easing of the lockdown.

This surge is likely in categories such as mobile phones, tablets, laptops and other work-from-home enablers. Flipkart has noticed people in lockdown searching for masks, sanitisers, home appliances, personal grooming products and even shoes.

For white goods, beginning of the summer is the start of the season for refrigerators and airconditioners, with April alone contributing 12% of the total sales of the latter, according to Manish Sharma, president & CEO, Panasonic India and South Asia.

When India went into the lockdown, many regions transitioned from winter/spring to summer. “Buyers won’t come out like in the past. Expect more online sales even as vacuum cleaners and dishwashers find a lot of traction,” Sharma says.

Even data consumption could see a change in usage. Director general of Cellular Operators Association of India Rajan S Mathews says there was a 20% surge in demand for data during the lockdown. After that period ends, he expects some traffic to shift from homes to offices.

The lockdown has seen people exhausting their stock of liquor, cigarettes and other sin goods. Reports of a black market in alcohol and cigarettes taking root, with inflated prices, have surfaced in the cities. While people are generally more conscious of health now, Roshini Sanah Jaiswal, chief restructuring officer at Jagatjit Industries, expects a 20-25% surge in liquor sales when the lockdown lifts. About 360 million cases of liquor are sold every year (12 bottles of 750 ml comprise a case). With no sales in April, there is already a pent-up demand for 30 million cases.

“When you take something away, there will be panic buying. We see a surge in demand and people might buy more fearing another lockdown,” says Jaiswal. On reports of illicit trade during lockdown, she says: “Every state government is dependent on excise revenue from liquor. This revenue can create greater good. In fact, liquor shops should be allowed to open even in a lockdown to discourage any illegal trade.”

While lifting lockdown will allow consumers to re-stock the bar, they are likely to go for cheaper options to conserve cash. “Last few years the trend was shifting to premium brands, now buyers will be fine with one notch lower,” adds Jaiswal.

While more people will spend to consume at home and even hoard spirits, overall sales will be hit as bars and restaurants remain shut. Besides, the lack of weddings, conferences and banquets will mean lower sales.

Even as consumers spend with an eye on the wallet, they might see jewellery as both a safe haven and an investment. Omnichannel jewellery retailer CaratLane claims a 100% increase in time spent by shoppers on its site. Atul Sinha, senior vice-president, retail, CaratLane, says: “Value might take a few weeks to regain with the same kind of intensity as pre-Covid, but the intent to purchase is up 1.5X.”

A close watch on the budget might translate into greater action in the market for used goods.

Classifieds platform OLX has seen a surge in interest for consumer electronics (particularly smartphones) and pre-owned cars. “We have seen maximum interest emerge across the categories of white goods (appliances and electronics), consumer electronics such as smartphones and preowned cars for personal transport,” said Tarun Sinha, head of OLX People.

With the markets gradually emerging out of the lockdown starting Monday, we will start witnessing these trends play out.

"consumption" - Google News

May 03, 2020 at 12:32AM

https://ift.tt/3b1wan7

As the great reopening gets underway starting Monday, how will the consumption story pan out? - Economic Times

"consumption" - Google News

https://ift.tt/2WkKCBC

https://ift.tt/2YCP29R

Bagikan Berita Ini

0 Response to "As the great reopening gets underway starting Monday, how will the consumption story pan out? - Economic Times"

Post a Comment