An important message throughout the COVID-19 crisis has been to “stay home”. Our analysis based on debit card purchase data until 15 June shows that this has a profound impact on where consumers spend their money. Cities have been hit hard, while in peripheral commuting zones, consumption expenditures have been even higher than in 2019. An interesting side-effect of staying at home is that expenditures are now more evenly spread in space; i.e. they are “spreading out”.

Measuring the consumption impact of COVID-19 in Switzerland

The Swiss Federal Council declared an “extraordinary situation” on 16 March and closed all shops and service providers except supermarkets, food shops, and pharmacies from 17 March. On 27 April, first shops (e.g. garden centres) and service providers (e.g. hairdressers) reopened. From 11 May all shops and restaurants were allowed to reopen. Our analysis is based on debit card purchases at points of sale in Switzerland (see data details at the end) which we observe by region and merchant category. We aggregate the daily data to calendar weeks and compare turnover (in million CHF) to that of the same calendar week in 2019.

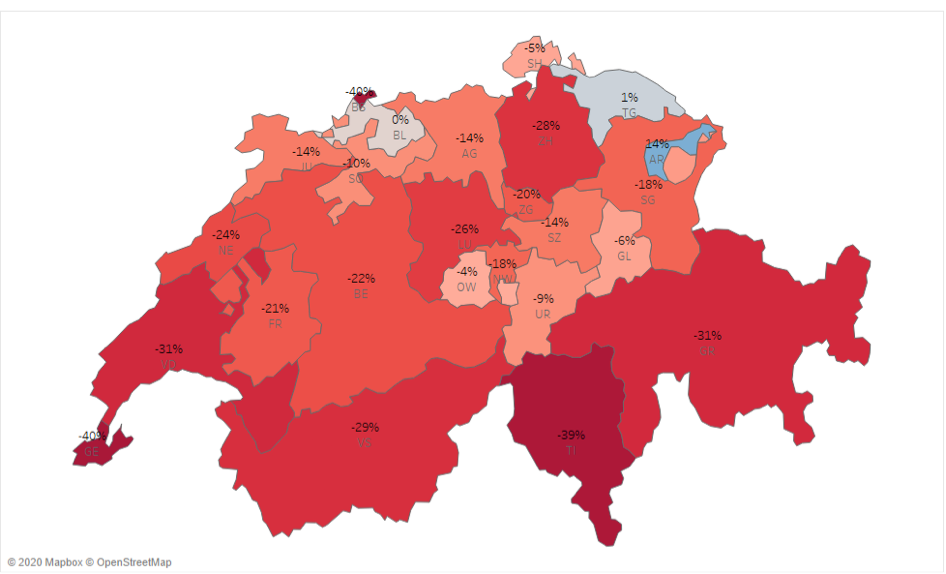

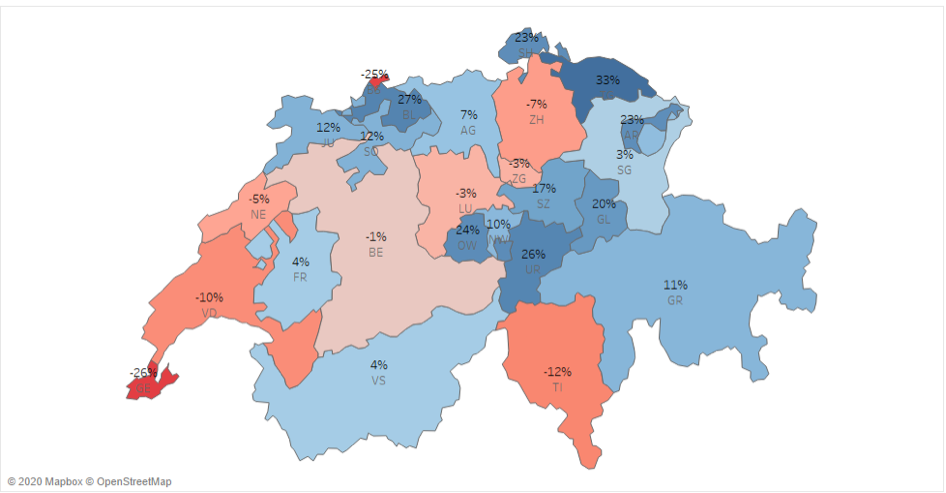

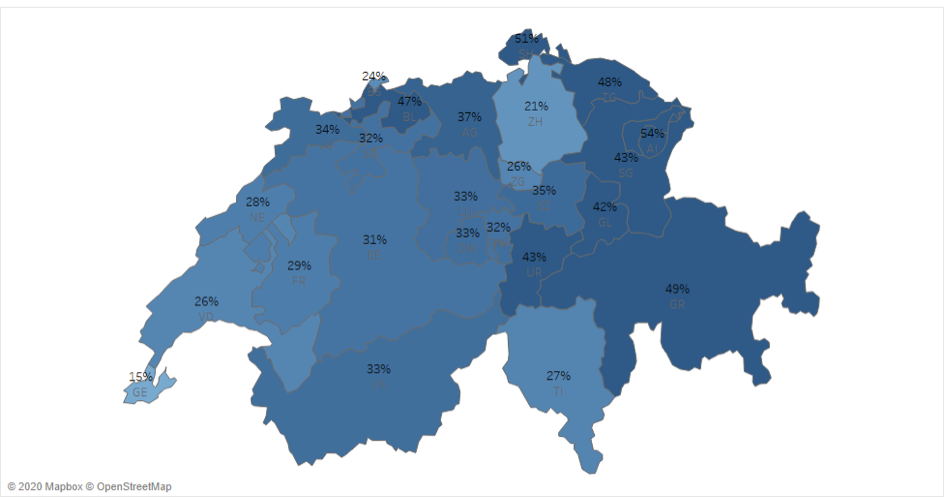

Figure 1. Year-on-year comparison of debit card purchase volume by canton in Switzerland

1A. Lockdown period: calendar weeks 12-17 (17 March – 26 April)

1B. Partial reopening period: calendar weeks 18-19 (27 April -10 May)

1C. After reopening of all shops: calendar weeks 20-24 (11 May – 15 June)

Notes: 2020 vs 2019 percentage change, calculated by transaction volume in CHF for same calendar weeks. Domestic debt cardholders only. Purchases measured at merchant location.

Cantons with large cities are hit harder and recover more slowly

The Swiss Confederation is made up of 26 cantons, each with its own legislature, executive and courts. Cantons that host the large cities, such as Zurich (ZH), Geneva (GE), Basel-Stadt (BS), or Vaud (VD) display comparatively large declines in consumption expenditures during the lockdown.. and weak recoveries thereafter (Figure 1). Take the city-canton of Basel-Stadt (BS) as an example. During the lockdown (calendar weeks 12-17), this canton experienced the strongest decline in consumption expenditures across Switzerland (-40% compared to 2019). Basel-Stadt also displays one of the weakest recoveries when the lockdown is partially lifted in (calendar weeks 18-19: -25%) and then fully lifted (calendar weeks 20-24: +24%). By comparison, the neighbouring canton Basel-Land (BL) displays purchase levels similar to 2019 during the lockdown and one of the strongest rebounds when the lockdown is lifted. (calendar weeks 20-24: 47% compared to 2019)

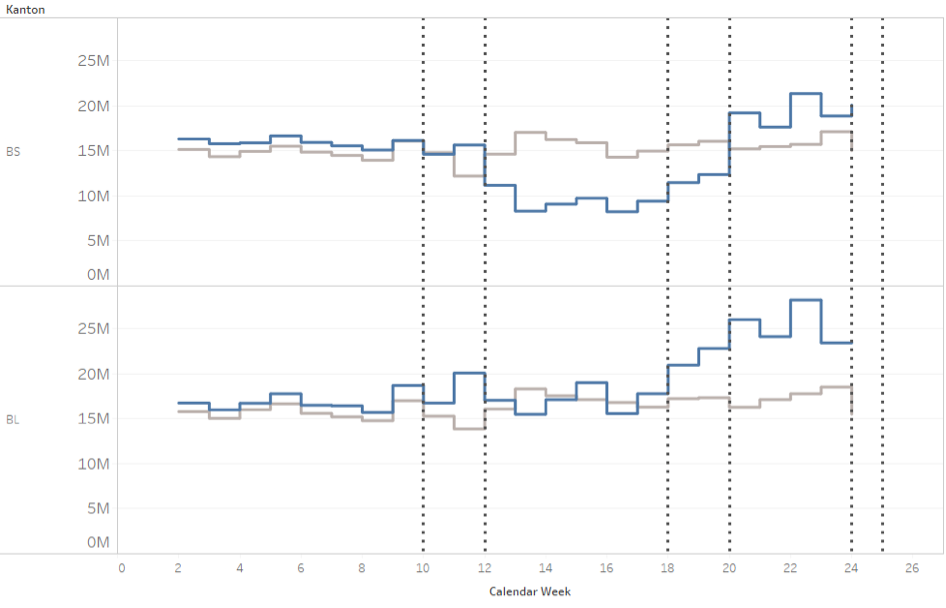

The comparison of Basel-Stadt and Basel-Land illustrates how differently consumption expenditures are impacted by COVID-19 and related policy measures in cities compared to peripheral regions. The two cantons display very similar developments in debit card purchases in January and February 2020 (both in absolute levels as well as compared to 2019). Then, they sharply diverge. (Figure 2)

Figure 2. Debit card purchases by canton: Basel-Stadt (BS) vs. Basel-Land (BL)

Notes: Volume in million CHF by year and calendar week

Working from home… shopping in the neighbourhood

Why do urban cantons like Basel-Stadt experience such a strong negative shock during the lockdown and weak recovery thereafter? One reason seems to be the reduced flow of commuters. As a major regional city, Basel attracts a large number of domestic and cross-border commuters for work. Importantly, many of these commuters work in professions that can also be done from home. The University of Basel’s home-office index reveals that for jobs located in the cantons of Basel-Stadt, Geneva or Zurich the likelihood is particularly high that that job can be done from home.

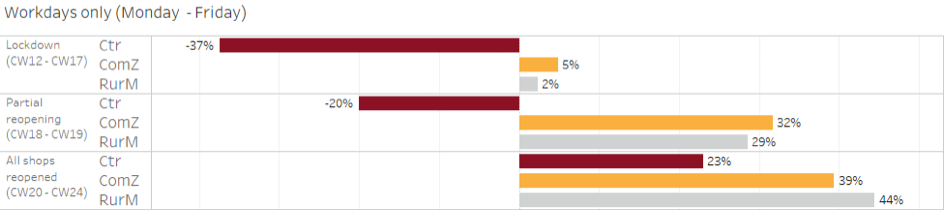

To capture the impact of changed commuter flows on consumption we compare debit card purchases by municipal urbanisation on workdays only. This comparison—for the whole country—reveals that city-centres experienced a much more significant decline in consumption during the lockdown (calendar weeks 12-17: -37% compared to 2019) than municipalities in commuting zones (+5%). Even after the full reopening of shops, the catching-up effect on consumption has been much weaker in cities (calendar weeks 20-24: +23%) compared to commuting zones (+39%). See Figure 3.

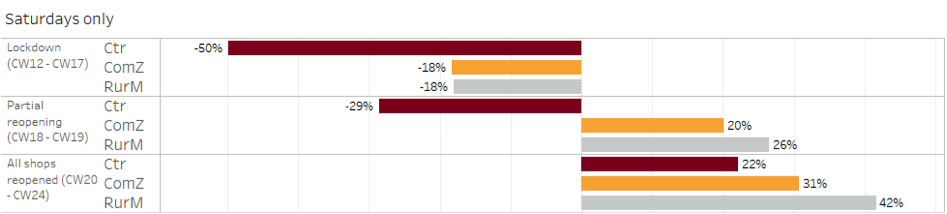

Weekend city centre shopping… catching up slowly

City centres not only attract commuters for work… they also attract significant flows of (weekend) shoppers. Our data suggests that the decline in city-centre shopping during the lockdown was particularly strong on Saturdays (calendar weeks 12-17: -50% compared to 2019). After shops fully reopened, the increase in spending was particularly mild for weekend city-centre shoppers (calendar weeks 20-24: + 22%). In commuting zones around the cities, Saturday shopping also declined during the lockdown (calendar weeks 12-17: -18% compared to 2019), revealing that consumers increasingly spread out their purchases across the days of the week. But again, after all shops reopened, the rebound in consumption has been much stronger in commuting zones (calendar weeks 20-24: + 31%) than in city centres.

Figure 3. Debit card purchases, by urbanisation of municipality

Notes: Lockdown and reopening (calendar weeks 18-24). 2020 vs 2019 percentage change, calculated by transaction volume in CHF for same calendar weeks. Domestic debit card holders only. Purchases measured at merchant location. Ctr = city centre ComZ = commuting zone; RurM = rural municipality

Authors’ notes: The data underlying this analysis reports the point-of-sale (PoS) transactions of debit cards issued by banks to their customers in Switzerland. PoS transactions are payments with a debit card at a point of sale, e.g. a shop or a service provider (hairdresser, restaurant, petrol station). Data provider: SIX BBS AG. Data available here: http://monitoringconsumption.org/data

♣♣♣

Notes:

- This blog post is based on Monitoring Consumption Switzerland, a joint initiative of the University of St. Gallen, the University of Lausanne, and Novalytica, together with Robert Rohrkemper (senior data scientist, Worldline).

- expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Nathan Queloz on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Martin Brown is professor of banking at the University of St. Gallen. His research is focused on money and banking, household finance and payment behaviour.

Martin Brown is professor of banking at the University of St. Gallen. His research is focused on money and banking, household finance and payment behaviour.

Matthias Fengler is professor of econometrics at the University of St. Gallen. He works in financial econometrics, asset pricing, volatility modeling, and risk-management.

Matthias Fengler is professor of econometrics at the University of St. Gallen. He works in financial econometrics, asset pricing, volatility modeling, and risk-management.

Rafael Lalive is professor of economics at the University of Lausanne. He works on questions related to social economics and labour economics, and how COVID-19 affects these areas of research.

Rafael Lalive is professor of economics at the University of Lausanne. He works on questions related to social economics and labour economics, and how COVID-19 affects these areas of research.

Robert Rohrkemper is a senior data scientist and distinguished expert at Worldline. He implements machine learning and AI capabilities to enhance fraud detection and to enable novel data-driven use cases in the electronic payments industry.

Robert Rohrkemper is a senior data scientist and distinguished expert at Worldline. He implements machine learning and AI capabilities to enhance fraud detection and to enable novel data-driven use cases in the electronic payments industry.

Thomas Spycher is partner and co-founder at the data analytics company Novalytica. He focuses on the analysis and modelling of local-level data for clients in real estate and marketing.

Thomas Spycher is partner and co-founder at the data analytics company Novalytica. He focuses on the analysis and modelling of local-level data for clients in real estate and marketing.

"consumption" - Google News

June 30, 2020 at 11:37AM

https://ift.tt/2VwkWCm

Spreading out: COVID-19 and the changing geography of consumption - USAPP American Politics and Policy (blog)

"consumption" - Google News

https://ift.tt/2WkKCBC

https://ift.tt/2YCP29R

Bagikan Berita Ini

0 Response to "Spreading out: COVID-19 and the changing geography of consumption - USAPP American Politics and Policy (blog)"

Post a Comment